If you are thinking of buying a new car or want to upgrade your car in 2026, a car loan can help to make this dream come true without paying the full amount upfront. But before taking a loan, it’s important to know how much the buyer will need to pay every month. That’s where the HDFC Bank Car Loan Calculator 2026 helps. It’s a simple online tool that shows the monthly EMI in just a few seconds based on the car price and car loan tenure period. This calculator helps the buyer to plan their budget, compare loan options, and understand how much interest they need to pay without visiting the bank.

HDFC Bank Car Loan Calculator 2026

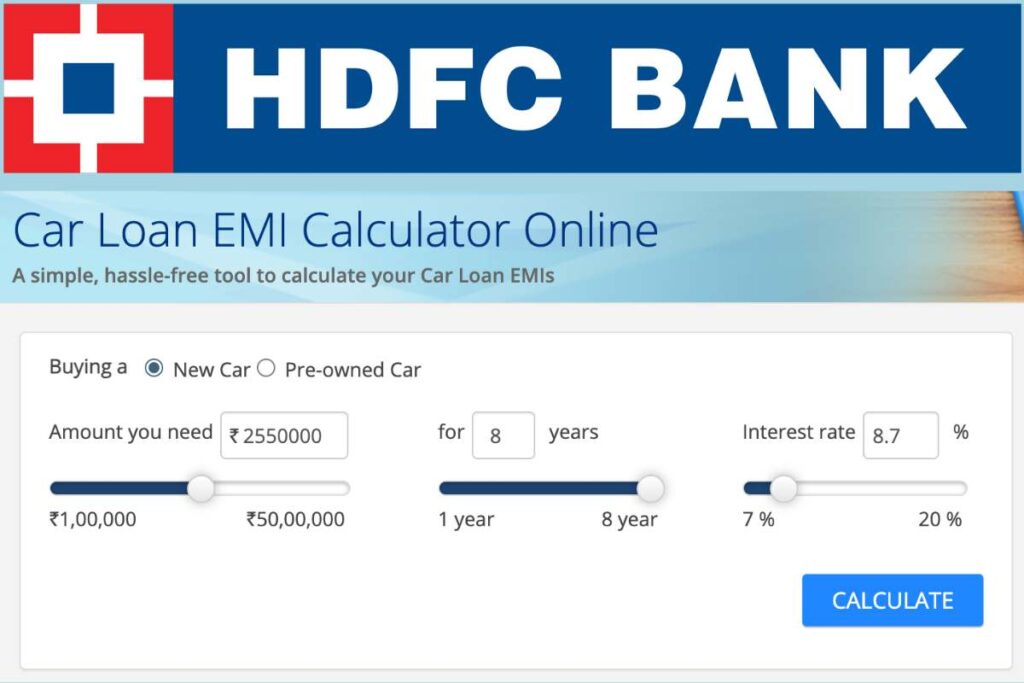

The HDFC Bank Car Loan Calculator 2026 is an easy to use online tool that helps car buyers to find out their monthly EMI before applying for a car loan. By simply entering the amount of the loan, interest rate and the loan repayment years, this calculator gives an instant estimate of the monthly repayment amount. This tool is especially helpful for planning the finances, comparing different loan options and avoiding surprises later. Whether someone is planning to buy a new car or a pre owned car this calculator lets buyers experiment with different combinations to choose the most budget friendly option. This calculator is Available 24/7 on HDFC Bank’s official website and this free calculator is ideal for anyone looking to take a car loan in 2026.

- PM Kera Suraksha Insurance Scheme 2026

- Preparation Tips To Crack PTET Exam In 2026

- PM TEC Internship Scheme 2026

- PM Paramparagat Krishi Vikas Yojana 2026

Also Read PTET 2026 Registration, Notification, Online Form

PTET 2026 Registration, Notification, Online Form

HDFC Car Loan 2026- Quick Facts

| Post Title | HDFC Bank Car Loan Calculator 2026 |

| Year | 2026 |

| Name of Online Tool | Car Loan Calulator |

| Name of the Bank | HDFC Bank |

| Who can get a loan? | Salaried & Self Employed Individuals who are minimum 21 years aged but not older than 60 years |

| Income Requirements | Minimum: Rs. 3,00,000/Year |

| Fee Charges | Rs. 650 for Documentation / Rs. 500 for Repayment Mode Changes Charges / Rs. 50 for CIBIL Charges and more |

| Documents Required? | Identity & Address Proof, Latest salary slip, Bank statement for past 6 months, ITR if self-employed |

| Interest Rate | 8% to 20% |

| Number of Re-Payment Years | 1 to 7 Years |

| Car Loan Amount | Ranges from Rs. 1,00,000 to Rs. 3,50,00,000 |

| Online HDFC Car Loan Calculator 2026 | Calculator |

| Official Web Portal | www.hdfcbank.com |

How To Use HDFC Car Loan EMI Calculator 2026?

- Visit the official online HDFC Car Loan Calculator 2026.

- Choose whether purchasing a pre -owned or a new car.

- Provide the Loan amount which depends on the price of the car. HDFC Bank usually provides car loans from Rs. 1,00,000 to Rs. 3,50,00,000.

- Choose the loan tenure from 1 year to 7 years.

- Choose the applicable interest rate ranges from 7% to 20%.

- Click on the Calculate option.

- The monthly EMI Amount would be provided.

Who Can Get HDFC Car Loan In 2026?

Salaried Individuals: Any person who is salaried from public or private companies can get a car loan. That person should be aged 21 to 60 years. The salaried employee must be employed for minimum 2 years and minimum 1 year with the current employer. The annual salary must be a minimum Rs. 3,00,000.

Self Employed & Professionals (Sole Proprietorship): Any self employed person who is a sole proprietor in the business of trading, services or manufacturing can get a car loan. That person should be aged 21 to 60 years. The self-employed person must be in a sole proprietorship business for 2 years. The annual income must be a minimum Rs. 3,00,000.

Self Employed & Professionals (Partnership Firms): Any self employed partners in the business of trading, services or manufacturing can get a car loan. The annual turnover must be a minimum Rs. 3,00,000.

Self Employed & Professionals (Private Ltd. Co.): Any person who owns a private company in the business of trading, services or manufacturing can get a car loan. The income must be a minimum Rs. 3,00,000 per annum.

Self Employed & Professionals (Public Ltd. Co.): Any person who is a director in a Public Limited Company in the business of trading, services or manufacturing can get a car loan. The income must be a minimum Rs. 3,00,000 per annum.

FAQs Related To HDFC Bank Car Loan Calculator 2026

How can buyers use HDFC EMI Car Loan Calculator 2026?

Buyers can use the HDFC EMI Car Loan Calculator 2026 by inputting the loan amount, loan duration, interest rate.

For how much period HDFC Bank provides a Car Loan?

HDFC Banks provides 1 year to 7 years to repay the car loan but if buyers buy Electric vehicles then the repayment can be done in 8 Years.

Who Qualified for a HDFC Car Loan 2026?

Check out the full eligibility requirements in the above guide.

How much Interest buyers need to pay on HDFC Car Loan 2026?

The HDFC Car Loan Interest 2026 ranges from 7% to 20%.